"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

02/27/2018 at 12:53 • Filed to: None

0

0

25

25

"Textured Soy Protein" (texturedsoyprotein)

"Textured Soy Protein" (texturedsoyprotein)

02/27/2018 at 12:53 • Filed to: None |  0 0

|  25 25 |

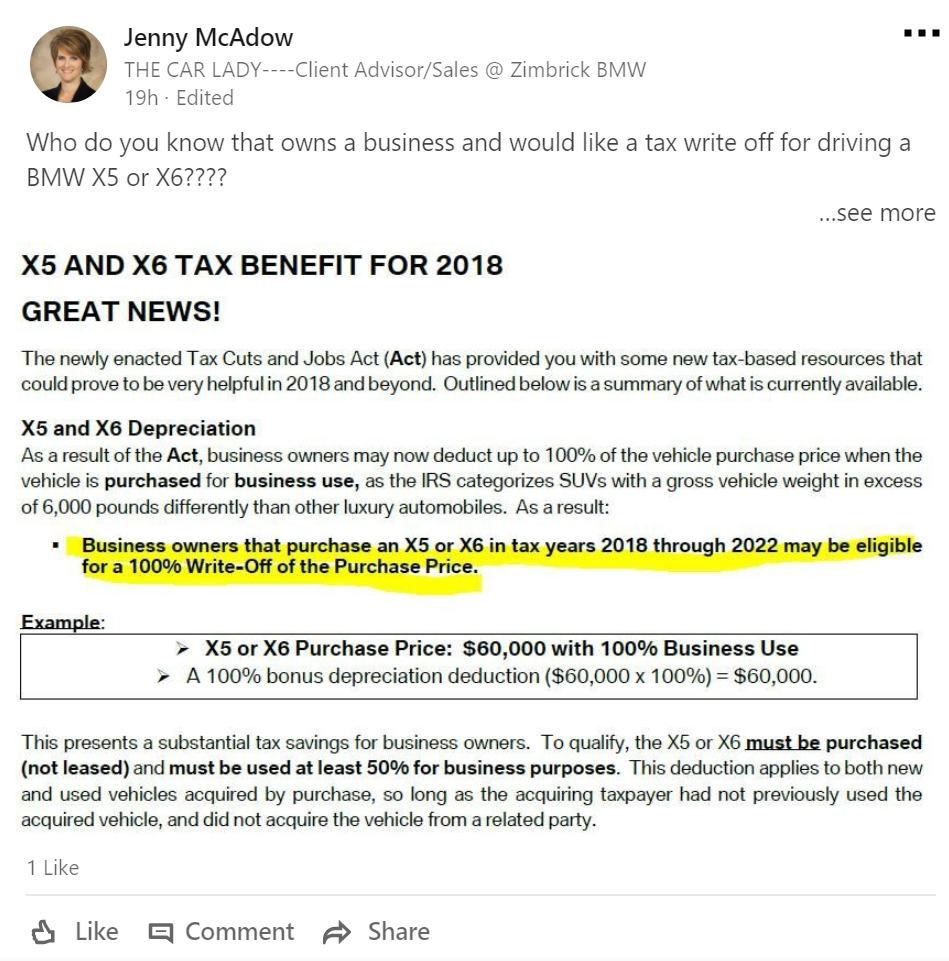

Yes, I’m apparently the kind of guy who is connected on Linkedin to the sales person who sold him a BMW one time. But hey, now I get to learn about this amazing GOP tax incentive for Bavarian (by way of South Carolina) SUVs. Even the dumbass X6 qualifies!

UPDATE: I went and found the !!!error: Indecipherable SUB-paragraph formatting!!! . The formatting is a mess and the only thing I could find is in relation to the depreciation deduction amounts on sub-6,000 lb GVWR passenger vehicles, which have all been raised. Here’s what I found, with the formatting cleaned up.

The “Hummer deduction” is in a different section where businesses can deduct up to 100% of the value of a vehicle over 6,000 lbs, depending on how much of the use of the vehicle is “for business.” Most people deduct something less than 100% of the value in order to not get too much attention.

For vehicles under 6,000 lbs GVWR, there are limits on how much depreciation of that vehicle can be claimed as a deduction. The new tax bill significantly raises those limits. But...that doesn’t apply to the X5 and X6 which are over 6,000 lbs GVWR.

Here’s the changes:

2. Modifications to depreciation limitations on luxury automobiles and personal use property (sec. 13202 of the Senate amendment and sec. 280F of the Code)

PRESENT LAW

Section 280F(a) limits the annual cost recovery deduction with respect to certain passenger automobiles. This limitation is commonly referred to as the “luxury automobile depreciation limitation.” For passenger automobiles placed in service in 2017, and for which the additional first-year depreciation deduction under section 168(k) is not claimed, the maximum amount of allowable depreciation is $3,160 for the year in which the vehicle is placed in service, $5,100 for the second year, $3,050 for the third year, and $1,875 for the fourth and later years in the recovery period.

This limitation is indexed for inflation and applies to the aggregate deduction provided under present law for depreciation and section 179 expensing. Hence, passenger automobiles subject to section 280F are eligible for section 179 expensing only to the extent of the applicable limits contained in section 280F.

For purposes of the depreciation limitation, passenger automobiles are defined broadly to include any four-wheeled vehicles that are manufactured primarily for use on public streets, roads, and highways and which are rated at 6,000 pounds unloaded gross vehicle weight or less. In the case of a truck or a van, the depreciation limitation applies to vehicles that are rated at 6,000 pounds gross vehicle weight or less. Sport utility vehicles are treated as a truck for the purpose of applying the section 280F limitation.

Basis not recovered in the recovery period of a passenger automobile is allowable as an expense in subsequent taxable years. The expensed amount is limited in each such subsequent taxable year to the amount of the limitation in the fourth year in the recovery period.

SEC. 13202. MODIFICATIONS TO DEPRECIATION LIMITATIONS ON LUXURY AUTOMOBILES AND PERSONAL USE PROPERTY.

LUXURY AUTOMOBILES.—IN GENERAL.—280F(a)(1)(A) is amended—

(A) in clause (i), by striking ‘‘$2,560’’ and inserting ‘‘$10,000’’,

(B) in clause (ii), by striking ‘‘$4,100’’ and inserting ‘‘$16,000’’,

(C) in clause (iii), by striking ‘‘$2,450’’ and inserting ‘‘$9,600’’, and

(D) in clause (iv), by striking ‘‘$1,475’’ and inserting ‘‘$5,760’’.

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

02/27/2018 at 12:59 |

|

meh, this has always been the case, the “cut, cut, cut” bill didn’t change that.

The sales man is being extra slick lol

For Sweden

> Textured Soy Protein

For Sweden

> Textured Soy Protein

02/27/2018 at 12:59 |

|

Is vehicle depreciation tax deductible? Because then every BMW is 100% tax deductible.

benjrblant

> Textured Soy Protein

benjrblant

> Textured Soy Protein

02/27/2018 at 13:02 |

|

IIRC, all the X5 and X6 are assembled in North Carolina, even the ones for export.

HammerheadFistpunch

> Textured Soy Protein

HammerheadFistpunch

> Textured Soy Protein

02/27/2018 at 13:03 |

|

I thought they moved the GVWR up and or closed that loophole, was it specifically reponened in the “Make My Friends Richer” plan of 2018?

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

02/27/2018 at 13:04 |

|

Has the full purchase price been deductible?

The sales “man” is a lady named Jenny.

Ash78, voting early and often

> Textured Soy Protein

Ash78, voting early and often

> Textured Soy Protein

02/27/2018 at 13:06 |

|

The GOP have been the biggest proponents of tax breaks for luring foreign automakers to the US, so IMHO this is perfectly in character for them. If anything, the traditional Big 3 are more of a Dem thing (because UAW)

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

02/27/2018 at 13:08 |

|

Yea, the bonus depreciation has always been a thing, its to encourage businesses to invest in new assets, Machinery and equipment, etc.

So you could either take all the expense in that one year (bonus), or spread it over the life (standard).

E92M3

> For Sweden

E92M3

> For Sweden

02/27/2018 at 13:16 |

|

There is a GVWR requirement of 6,000lbs unless they changed it.

It was designed for pickups, cargo, vans, etc. This loophole is one reason so many Tahoe’s, Suburbans, and Escalades are sold.

Sampsonite24-Earth's Least Likeliest Hero

> benjrblant

Sampsonite24-Earth's Least Likeliest Hero

> benjrblant

02/27/2018 at 13:16 |

|

*south

Textured Soy Protein

> benjrblant

Textured Soy Protein

> benjrblant

02/27/2018 at 13:20 |

|

Spartansburg, SC. Which is why I said Bavarian (by way of South Carolina). BMW happens to have a website all about it which was promoted on the front page of bmwusa.com shortly after Trump started ranting about German cars.

Textured Soy Protein

> HammerheadFistpunch

Textured Soy Protein

> HammerheadFistpunch

02/27/2018 at 13:23 |

|

They raised the maximum depreciation deductions. Post is now updated.

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

02/27/2018 at 13:23 |

|

I updated the post with the bill text, apparently the depreciation limits are now higher.

Textured Soy Protein

> Ash78, voting early and often

Textured Soy Protein

> Ash78, voting early and often

02/27/2018 at 13:24 |

|

Well, this also covers any expensive ‘Murrican trucks & SUVs.

Ash78, voting early and often

> Textured Soy Protein

Ash78, voting early and often

> Textured Soy Protein

02/27/2018 at 13:26 |

|

Everyone wins except the environment!

BahamaTodd

> E92M3

BahamaTodd

> E92M3

02/27/2018 at 13:37 |

|

and why it used to be known as the Hummer tax.

HammerheadFistpunch

> Textured Soy Protein

HammerheadFistpunch

> Textured Soy Protein

02/27/2018 at 13:37 |

|

Look I don’t speak tax code so well, I have a guy do my taxes, but how can this be seen in any light other than robbing the poor to pay the rich. You can deduct over $40,000 from something you don’t (by definition) need, but it means we can’t find the money in the budget to live within our means? Free market? In the free market this person would go bankrupt and have his assets seized. This tax code is the largests and stinkiest part of a seriously stinky office.

fyi - not directed at you, just venting.

Spanfeller is a twat

> Textured Soy Protein

Spanfeller is a twat

> Textured Soy Protein

02/27/2018 at 13:40 |

|

Do 2AM booty calls with the secretary qualify as “business use” ?

Textured Soy Protein

> HammerheadFistpunch

Textured Soy Protein

> HammerheadFistpunch

02/27/2018 at 13:52 |

|

Yeah I hear ya.

I now think I understand.

The ability to deduct the purchase price of vehicles greater than 6,000 lbs was already there.

The new bill raises the amount of depreciation that can be deducted for vehicles under 6,000 lbs GVWR. The old version allowed $13,185 worth of depreciation to be deducted over 4 years. Now it’s 41,360.

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

02/27/2018 at 14:44 |

|

LOL that’s why I was confused. BMWs dont make that 6000lbs cut.

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

02/27/2018 at 14:58 |

|

Keep in mind that 6,000 lbs is the GVWR not the weight of the car itself. BMW doesn’t list GVWR on its site but googling it seems to show the X5 and X6 are above 6,000 lbs GVWR.

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

ESSSIX GmbH - Accountant/Wagon Thumper

> Textured Soy Protein

02/27/2018 at 15:05 |

|

lol then we’re back at square one, and they could have always taken the bonus depr.

I got to get back to work. lol

e36Jeff now drives a ZHP

> Textured Soy Protein

e36Jeff now drives a ZHP

> Textured Soy Protein

02/27/2018 at 15:08 |

|

To be fair, they are the largest vehicle exporter in the US by total value of goods. Attacking them was pretty dumb. They are exactly the kind of company that could afford to pull up roots and move somewhere else if they got slapped with a huge import tax.

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

Textured Soy Protein

> ESSSIX GmbH - Accountant/Wagon Thumper

02/27/2018 at 15:08 |

|

Right, as far as I (as a non-accountant/lawyer) can tell, the new bill has nothing to do with >6,000 lbs GVWR vehicles like the X5 and X6. It does however raise the depreciation amounts for <6,000 lbs GVWR vehicles.

404 - User No Longer Available

> Textured Soy Protein

404 - User No Longer Available

> Textured Soy Protein

02/27/2018 at 17:16 |

|

X5 and X6 are built in South Carolina?

Textured Soy Protein

> 404 - User No Longer Available

Textured Soy Protein

> 404 - User No Longer Available

02/27/2018 at 17:31 |

|

All BMW X models (except the 1 and 2) sold worldwide are built in South Carolina. It’s BMW’s largest factory.